After 30 years of coverage on Sky, the WWE has moved from Sky Sports to BT Sport. The move was seen as a shock after 3 decades of a relationship came to an end, but this is not the first time we have seen sporting properties move from Sky to BT. BT Sport famously nabbed some of the Premier League timeslots from Sky for the 2013/2014 season having won the rights to 38 EPL matches, and perhaps most famously, they struck a deal to broadcast the Champions League exclusively from the 2015/2016 season, and have held the European Football rights ever since. The end of this long-standing relationship between the WWE and Sky has led me to the question, what is the cost of viewership when moving broadcast rights from Sky Sports to BT Sport?

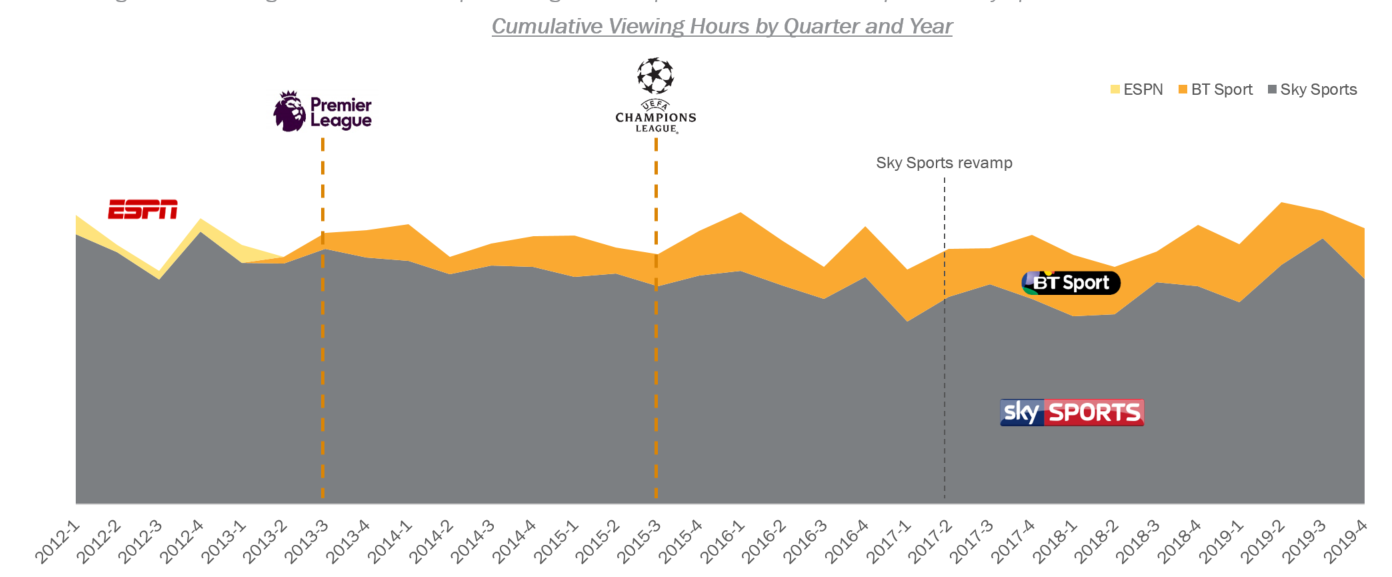

The introduction of these football properties resulted in an increase in BT Sport viewership, and a slight dip in Sky Sports viewership (as seen in the graph below). However, Sky Sports still received significantly higher viewing hours (1 person watching for 1 hour). So how did this affect some of the properties that made the switch from Sky to BT?

Premier League

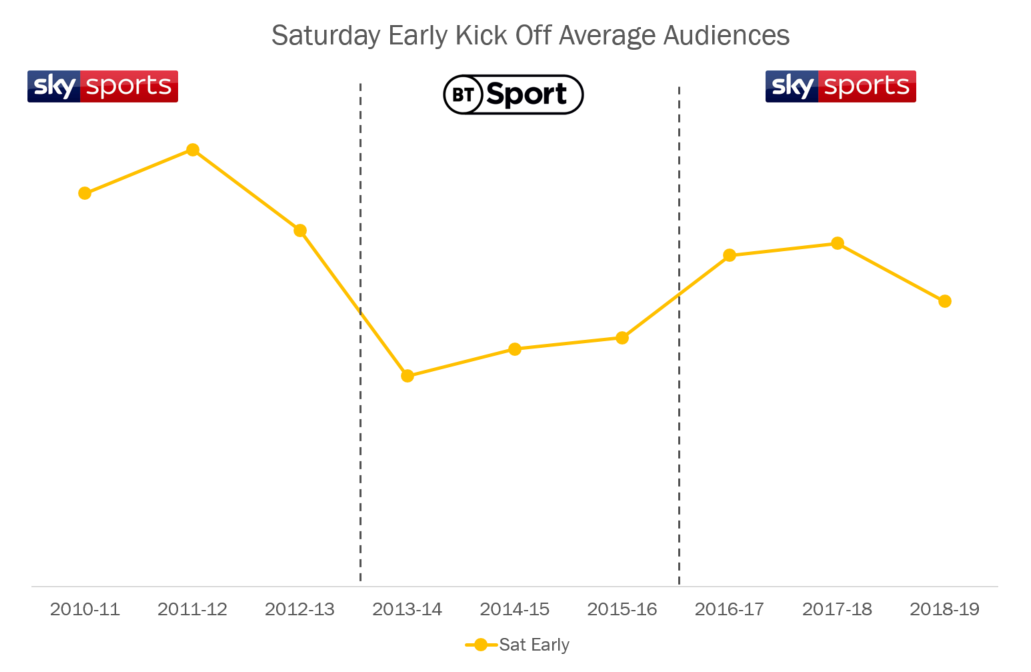

BT Sport’s first showing of Premier League football in 2013-14 began with the broadcasts of the Saturday Early kick offs. Average viewership for this timeslot dropped 41% from the 2012-13 season when the matches were broadcast on Sky Sports. The average viewership for BT Sport in the three-year rights cycle eventually increased 18% by the 2015-16 season, however they still never reached the heights of Sky Sports average audience in the previous rights period.

As of the 2016-17 season, the new broadcast rights cycle began and the 12:30 kick offs moved back to Sky, with average viewership for the timeslot increasing 33% from the 2015-16 season. Interestingly however, the average viewership for the next 3 years never quite reached the peaks of the previous time that Sky had that particular timeslot, showing that some of their previous subscribers made the switch to BT, and never quite came back to Sky.

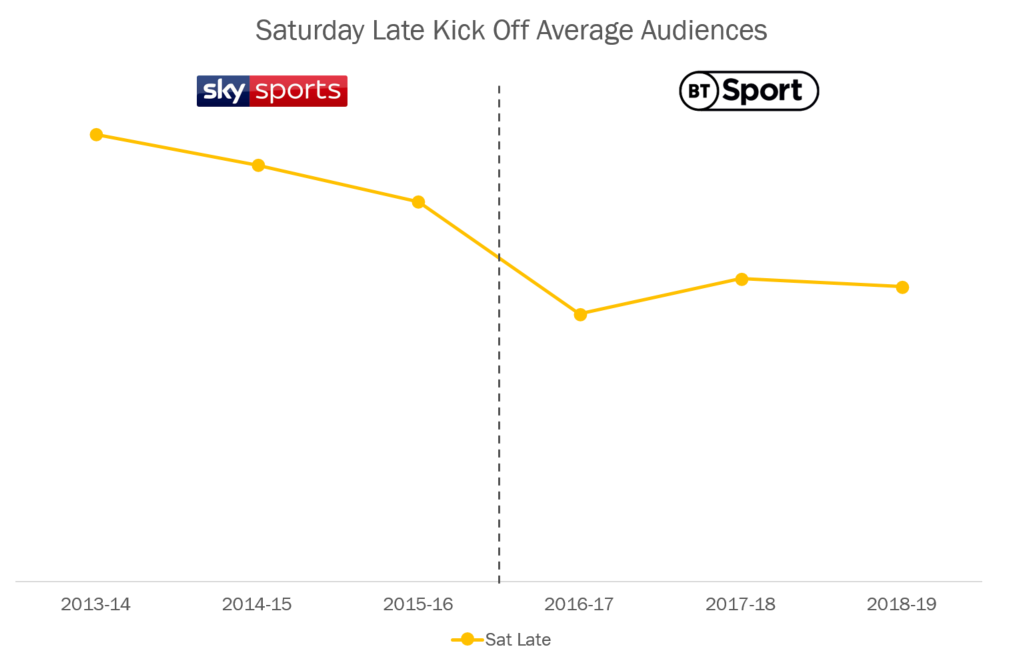

As alluded to earlier, the rights cycle in 2016-17 meant a change in regular timeslots for BT, with the channel now showing the Saturday Late kick offs. As with the Saturday Early timeslot, the move to BT resulted in an 30% loss in viewership from 2015-16 to 2016-17 for the Saturday Late timeslot. The BT viewership does receive a boost in its 2nd season broadcasting but as per the previous rights cycle, never quite reaches the heights of Sky Sports viewership.

Premiership Rugby

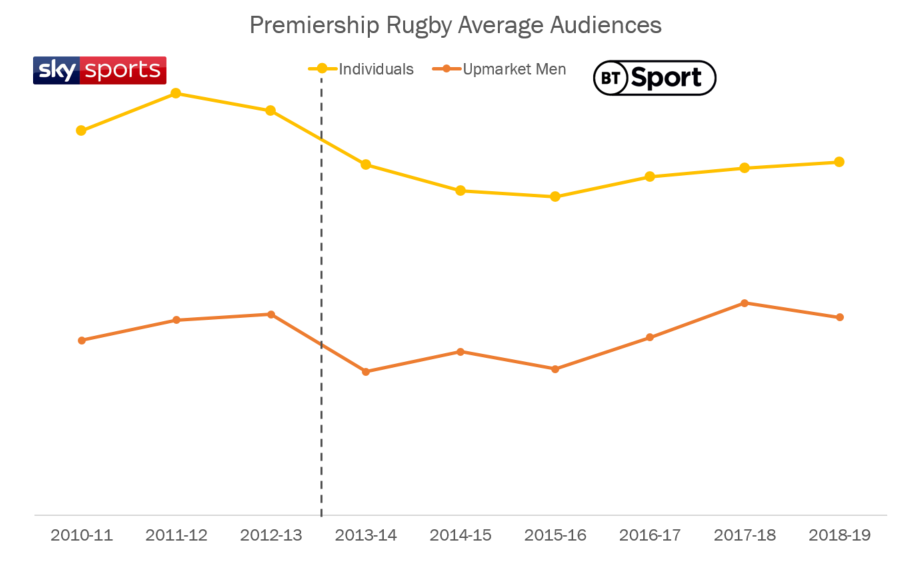

The trend seen in the Premier League also extends to less popular sports, with average viewership of Premiership Rugby also dropping after a switch to BT Sport in the 2013-14 season, albeit not as much, with a 13% drop from 2012-13 to 2013-14. This trend however, is not true for the upmarket male demographic. With rugby viewership predominantly made of upmarket males (as well as being the demographic that advertising is typically bought against), the average viewership for upmarket males has remained very similar throughout the seasons regardless of broadcaster. As rugby fans are typically upmarket males, this implies that this audience group can afford multiple Pay-TV subscriptions, therefore they follow Premiership Rugby to BT Sport and the audience doesn’t decline as much.

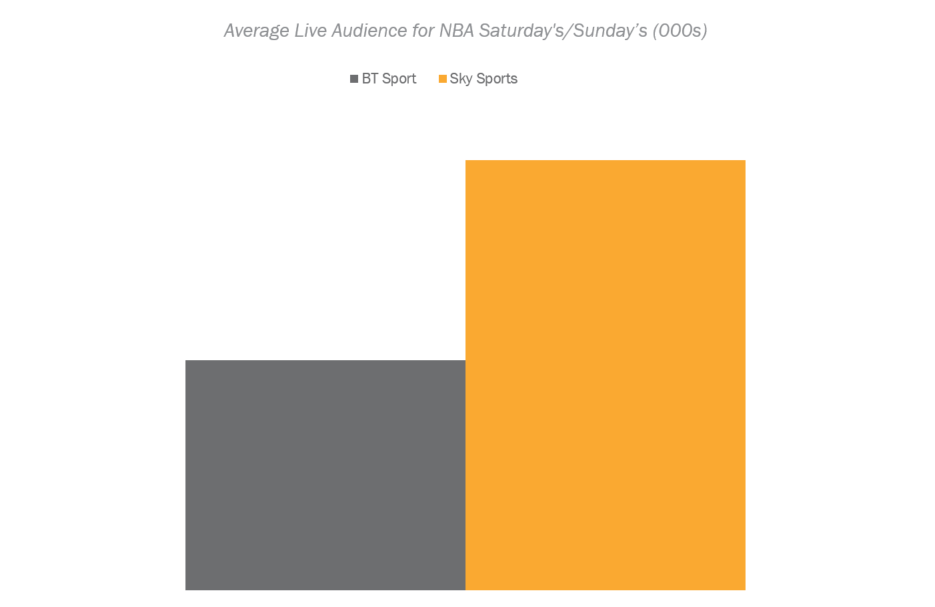

NBA

But what happens when a sport switches from BT to Sky I hear you ask? Well, the NBA recently switched from BT to Sky in the 2018/19 season. The move increased the NBA Saturday’s and Sunday’s (The NBA’s European Primetime initiative) average viewership by 50%, as well as introducing over half a million new unique viewers to the NBA.

So what will this mean for the WWE?

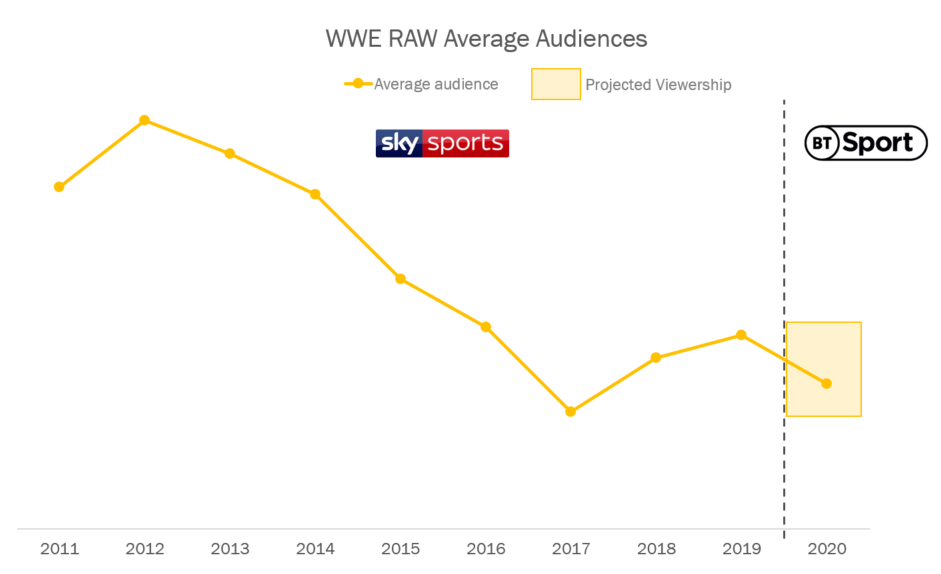

I have decided to look at the effect this would have on WWE Monday Night Raw, due to it always being broadcast live in the same timeslot throughout the years, compared to Smackdown which has often switched days and was a mixture of pre-taped and live. Not only this but Raw is traditionally seen as the “A” show.

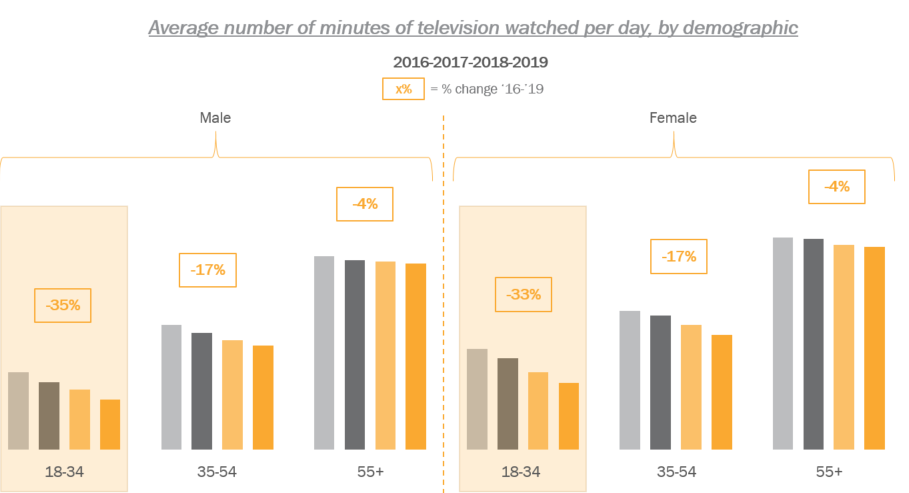

WWE Raw’s viewership is predominantly made up of the 18-34 demographic, which as we have seen throughout the years are watching less TV, with the introduction of OTT platforms (those such as the WWE Network).

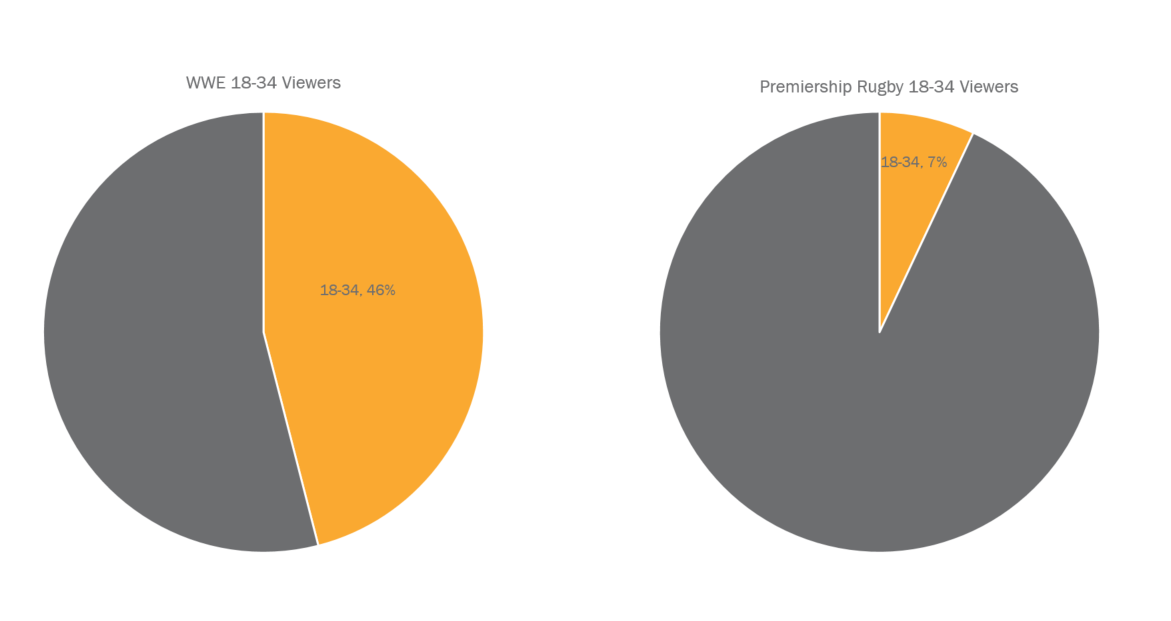

The WWE has a significantly younger viewership base than that of Premiership Rugby, which can be seen below:

This is particularly damaging for the WWE, with 90% of its total viewership (2010-2019) coming from viewers having recorded the programme and watching back, due to the live broadcasts being in the early hours of the morning, which can now be easily accessed on-demand on SkyGo and eventually on the WWE Network (albeit a few weeks delayed). Not only this, but Futures’ own market research** suggests that 60% of Sky Sports viewers do not have BT Sport, with a familiar figure amongst 18-34s, WWE’s target group.

We estimate WWE’s fall in average viewership to be similar to that of the Premier League (41% for Saturday early, 30% for Saturday late), despite the late start time (given most of the viewership is through playback), and unlike rugby, doesn’t attract an upmarket male audience who can afford multiple subscriptions. Tie that in with the fact 18-34s TV viewership is falling every year, we predict the average Monday Night Raw viewership to fall around 25-35% for the year 2020.

However, it is not all negative viewership news for the WWE. Despite a projected fall in live Monday Night Raw viewership, the Sports Entertainment brand has recently announced highlights broadcasts on FTA provider Channel 5, in a move which will increase their total cumulative viewership to a new high, given this will be the first time WWE has been broadcast on free-to-air television in 19 years.

** Futures Market Landscape Tracker runs on a monthly basis to 4,000 nationally representative respondents across the UK, Germany, France and Italy, investigating attitudes and behaviours in relation to sport and entertainment media consumption.